A Lasting Legacy

LEAVE A GIFT IN YOUR WILL TO PROTECT AUSTRALIA'S CULTURAL HERITAGE.

The National Trust of Australia (Queensland) relies on community generosity to protect our natural and cultural heritage.

Leaving a gift in your will is a powerful way to ensure our history, heritage, environment, and culture are preserved for future generations.

It's easy to leave a gift, big or small—your contribution truly makes a difference.

By leaving a small percentage or residual of your Estate, you can still provide for your loved ones while showing your commitment to saving Australia's culture and heritage.

GET IN TOUCH

Complete the form to get in touch with Georgia, or contact her directly via email (donate@nationaltrustqld.org) or phone (0409 980 474).

What your gift will support

The National Trust of Australia (Queensland) offers a meaningful avenue for individuals to contribute to the preservation of irreplaceable built heritage, museums, significant trees, and the environment.

Through engaging with the National Trust of Australia (Queensland) in your estate planning, you play a vital role in ensuring that these cultural and historical treasures are conserved and passed on to future generations.

The National Trust of Australia (Queensland) is a recognised not-for-profit organisation dedicated to environmental and heritage conservation. Our charitable mission provides individuals with the chance to engage with the environment, significant places, wildlife, collections, and stories.

We advocate for the promotion and advancement of the conservation, protection, and understanding of Australia's natural and cultural heritage, including the rich heritage of Australia's First Peoples, for public benefit and education.

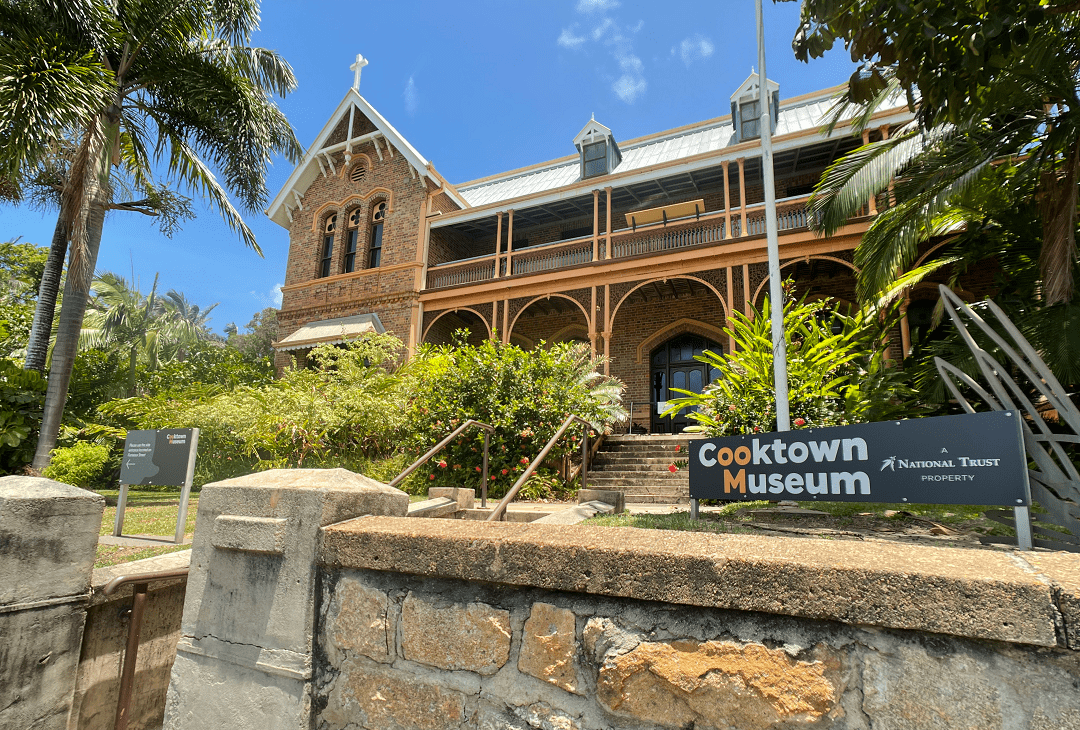

Statewide, our dedicated team of over 1000 volunteers and employees manage a diverse portfolio of properties, stretching from Currumbin Wildlife Sanctuary, Gold Coast to Cooktown Museum, Far North Queensland.

Please consider including the National Trust of Australia (Queensland) in your will to leave a lasting legacy for the benefit and enjoyment of generations to come.

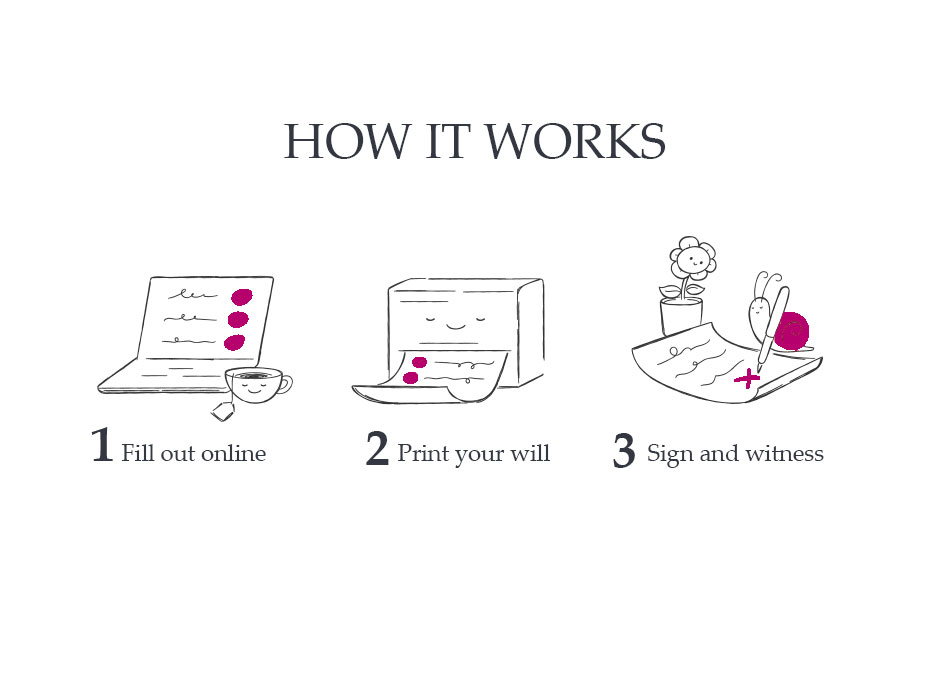

Update your will for free with a simple online will from Gathered Here

Having a will is one of the most important things you can do for your loved ones. It will reduce financial and emotional stress for them and ensure your assets go where you want them to, so the people you love are well looked after.

You can choose to include a gift in your will to reflect your love for built heritage, by leaving a gift in your will for National Trust Heritage Conservation, you are ensuring the conservation, protection and understanding of Australia's natural and cultural heritage for future generations.

Other Ways to Leave a Bequest to Heritage Conservation

Thank you for taking the time to consider the National Trust of Australia (Queensland) [NTAQ] in your will.

For many reasons, we are not able to give as generously during our lives as we might have wanted. The National Trust in Queensland is a registered charity and a deductible gift recipient. This allows you more flexibility in the type of gift and the timing of your gift based on your wishes.

We also encourage you to seek legal advice on the making of your will and to have a conversation with loved ones, so that your gift is understood.

Since 1963, NTAQ has been the recipient of several wills. Generous bequests and donations allow the National Trust to carry out its work to protect, conserve and celebrate Queensland's environmental, built, and cultural heritage.

Through generous gifts, we can:

-Implement and resource interpretation, education and learning programs to support curriculum guidelines and meet the needs of communities.

-Protect the natural reserves that contain endangered flora and fauna and help ensure that their environment and habitats are protected for future generations.

-Provide strong advocacy around the protection and conservation of our state heritage places.

-To bring into the direct care of The Trust, areas of heritage that are at a high risk of being lost as by their nature is unable to look after themselves.

-Care of the collection of works of art, furniture, decorative arts, and other materials that relate to historic properties.

-Maintain and provide community access to the National Trust of Australia (Queensland) portfolio of heritage places, buildings of interest, nature reserves and trails.

There are several ways you can leave a legacy to support environmental/natural, built, or cultural heritage:

Whole or part of your estate

You can leave your entire estate or any part of your estate to NTAQ.

A specific bequest

You can leave any identifiable property as a bequest to NTAQ in your Will. A specific gift may include any sum of money, cash balances in a bank account, a residential house, commercial real estate, or company shares.

A percentage of your estate

A common issue when determining a gift of a specific cash amount is: How can I decide on a figure when I do not know how much will be left in my estate when the time comes? Making your gift a percentage of your estate, or the residual of your estate means no matter what the value of your final estate, the proportion you intended for the NTAQ will remain the same.

A residual bequest

A residual gift to NTAQ is a direction to your Executor that, once all specific gifts are distributed to the beneficiaries named in your Will and your debts are paid, the remainder (or a proportion of the remainder) of your estate will be paid to NTAQ.

Gift in specie

If you are considering leaving real estate or shares to NTAQ, you may wish to consider leaving the gift in specie. This means the gift may be transferred directly to NTAQ and may save your estate by paying capital gains tax on the sale of the asset. We recommend you seek appropriate legal and/or financial advice before making your will to determine the suitability of a special gift.

Life Interest

Sometimes a supporter intends to gift a property to NTAQ but also wishes to allow a family member or friend to live in that home for some time. Once that time has passed, the property will be sold, and the proceeds paid to NTAQ.

Suggested wording...

Here is the correct wording for a gift to be made to The National Trust Australia (Queensland) in your Will or codicil (amendment to your Will).

‘I give:

(a) the residue (or percentage) of the residue of my estate; or

(b) the sum of $(amount); or (specified items)

to the National Trust of Australia (Queensland) Limited (ABN 85 836 591 486) to be held upon Trust and to be applied towards conservation purposes following the Constitutional objectives of the NATIONAL TRUST of AUSTRALIA (Queensland) in its absolute discretion to determine.’

A bequest that supports our work providing protection and conservation of the environmental, built, and cultural heritage, in general, provides us with the greatest flexibility to respond to critical priorities in the future; however, if you have a particular purpose in mind, please contact us to discuss your wishes.

Please let us know if you have included NTAQ in your Will or are considering it so we can assist you with the process and we can thank you properly.

Contact 07 5534 0873 or email info@nationaltrustqld.org